Introduction to Three Rivers Federal Credit Union

Three Rivers Federal Credit Union

Established with a vision to foster financial empowerment and community enrichment, Three Rivers Federal Credit Union has positioned itself as a beacon of trust and dependability amidst the financial service landscape. Our organization operates under the guiding principle of putting members at the heart of everything we do, ensuring that their financial aspirations become achievable realities.

Our core values are deeply embedded in our daily operations and decision-making processes. Integrity, confidentiality, and collaboration are not just words to us but pillars that uphold our commitment to excellence. We strive to create a symbiotic relationship with our members, fostering an environment reminiscent of familial bonds, where financial guidance is dispensed with genuine care and a vested interest in their success.

At Three Rivers Federal Credit Union, our commitment to our members transcends typical transactions. We aim to architect a financial pathway that is not only prosperous but also equitable, ensuring that every member, irrespective of their financial backdrop, receives the attention and support intrinsic to their growth. With unwavering dedication, we are constantly innovating and expanding our service offerings to adapt to the evolving needs of our community, reinforcing our promise to be a steadfast partner on our members’ financial journeys.

Explore our blog for updates to stay informed about the latest developments and insights from our institute. Consider becoming a part of our growing community—join our credit union for membership benefits today!

Our Mission

Our Enterprise Mission

At the very heart of our enterprise lies a mission that transcends routine business operations, steering us toward our envisioned future. Our fundamental goals are not mere abstractions; they are the bedrock upon which we build our strategies, shape our endeavors, and chart a course through an ever-evolving landscape. Comprised of both grand ambitions and meticulously detailed steps, our mission delineates the contours of our aspirations and serves as the lodestar guiding every facet of our operation.

Our goals orbit around the nucleus of transforming insights into impactful actions. By distilling complex ideas into meaningful solutions, we aim to craft an operational guide that not only aligns with our intrinsic ethos but also resonates with the broader community we seek to serve. This involves a steadfast commitment to innovation, a relentless pursuit of excellence, and an unwavering dedication to sustainable practices.

Embracing the intricacies of diverse challenges, our mission propels us to navigate the intricate tapestry of modern-day realities with ingenuity and foresight. Whether through fostering collaborative synergies or pioneering novel methodologies, our operational guide is a living document, dynamically evolving with the times while rooted in our core principles.

By maintaining an acute awareness of both our internal dynamics and external influences, we aim to elucidate a path where objectives are not simply met but exceeded. Our mission underscores a holistic approach, intertwining the pragmatism of goal attainment with the aspirations of forward-thinking innovation. Through this harmonized vision, we strive to redefine paradigms and catalyze impactful advancement, invigorated by the purpose that lies at the foundation of all that we undertake.

For more insights into our developments and initiatives, explore our blog for updates. To be part of our journey and enjoy exclusive benefits, join our credit union for membership benefits.

Our Vision

Envision a place where financial inclusivity is not just a peripheral notion but a foundational doctrine. This is the crux of our vision—a future where every community member relishes unfettered access to financial services tailored to empower their personal aspirations. Our credit union seeks to transcend the myopic purview of traditional financial institutions by crafting bespoke strategic directions that forefront innovation while remaining deeply anchored in community-centric values.

We strive to be at the vanguard of financial solutions, exploring avant-garde technologies and fostering an environment where transformation is continuous and proactive rather than remedial. By leveraging data analytics and cutting-edge fintech, we aim to anticipate our members' needs before they articulate them—a symbiotic relationship nurtured through trust and mutual growth.

While standing on the precipice of burgeoning opportunities, our future aspirations are not marooned in mere fiscal gains but are intrinsically linked to social stewardship. We envisage a future where our initiatives catalyze socio-economic mobility, eradicating the barriers that often shackle potential. Thus, our strategic blueprint pivots around sustainable practices, ethical governance, and an unwavering commitment to fostering an equitable financial ecosystem.

Through collaborative alliances and a relentless pursuit of excellence, we are charting a future that is as resilient and adaptable as it is visionary. This future positions us not merely as a financial institution but as a catalyst for positive change, where our members’ ambitions are nurtured, undergirded by a robust framework of support and innovation.

Explore our blog for updates and join our credit union for membership benefits.

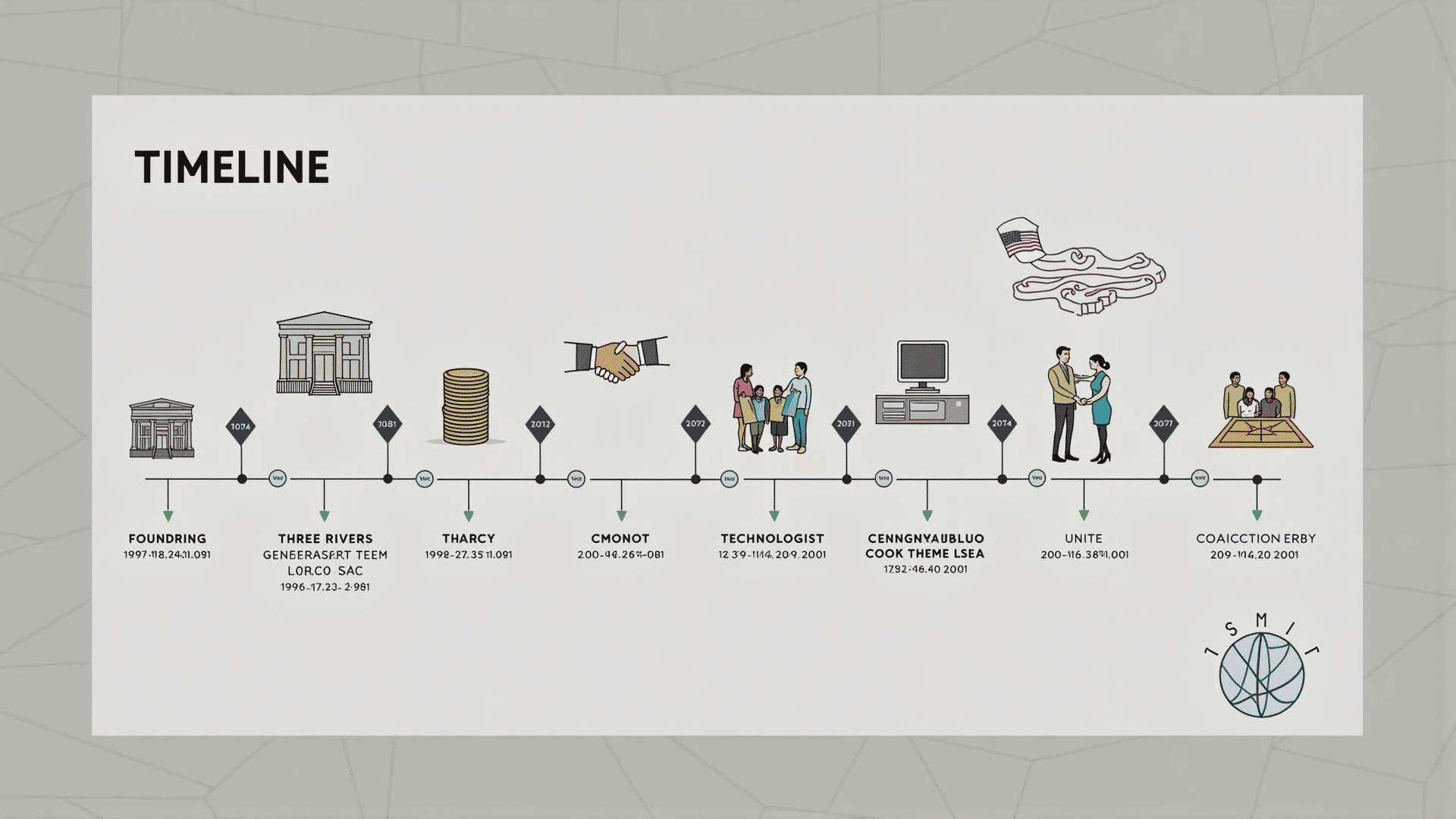

History of Three Rivers Federal Credit Union

Embarking on a retrospective journey, the venerable history of Three Rivers Federal Credit Union unfurls like a tapestry woven with tales of community commitment and financial ingenuity. The saga commenced not simply as a financial institution but as a beacon of communal synergy, emerging from the aspirations of a collective united by shared values and economic empowerment. Such origins can be traced back to a nascent phase when small yet significant steps were taken to lay foundational tenets that would guide the credit union's ethos through ensuing decades.

In its formative years, Three Rivers Federal Credit Union was a modest endeavor—its inception rooted in the post-war economic rejuvenation period. The 1930s marked a pivotal era, where ordinary individuals, driven by the quest for financial inclusivity, pooled resources to weather the financial storms of the era. It swiftly garnered members by offering an alternative to conventional banking—one characterized by mutual aid and democratic governance.

As the institution matured, it embraced milestones that were both ambitious and transformative. The ensuing decades witnessed a relentless pursuit of innovation intertwined with steadfast adherence to the principles of cooperative governance. Milestones such as the introduction of personalized financial services in the 1970s, the advent of digital banking solutions in the late 20th century, and the expansion into diverse community-centric initiatives underscore a legacy of adapting to the evolving economic landscape while remaining anchored to its foundational prerogatives. Explore our blog for updates.

Each chapter in Three Rivers Federal Credit Union's storied past is underpinned by an unwavering commitment to fostering economic advancement with a human touch. The transformative journey is continually chronicled and celebrated, each milestone a testament to the power of cooperation and the resilience inherent in the credit union paradigm. Join our credit union for membership benefits.

Benefits of Joining Three Rivers Federal Credit Union

Joining Three Rivers Federal Credit Union opens a gateway to a plethora of bespoke financial services tailored to meet the diverse needs of its members. As a community-focused financial institution, it offers an array of advantages that distinguish it from conventional banks. One standout feature is the member-centric ethos, ensuring that each member is more than just an account number. This personal touch manifests in competitive interest rates that outshine those found at most traditional banks, providing not only savings but also enhancing earning potential on deposits.

Members also enjoy the privilege of a vast network of fee-free ATMs, elevating convenience to new heights. Coupled with low or no fees on accounts, this fiscally prudent structure grants members the freedom to maintain liquidity without succumbing to exorbitant service charges that often erode financial health. Additionally, the member service is enveloped in a cloak of digital innovation and robustness, offering seamless online and mobile banking platforms that empower members with the ability to manage their finances anytime, anywhere.

Further, the Credit Union's unique dividend-paying structure distributes surplus earnings back to its members, ensuring shared prosperity through dividends and lower loan rates — a stark contrast to the profit-oriented model of large banks. This financial camaraderie fosters a sense of community and partnership, allowing members to benefit from the collective success of the credit union. Enveloping these incentives is an unwavering commitment to individualized financial counseling, where expert guidance helps members optimize their financial strategies, making the decision to join Three Rivers Federal Credit Union not just a financial transaction, but a strategic investment in one's financial future. For more insights and updates, explore our blog.